Yes you heard it right it’s just a couple weeks’ time left to file your taxes, But you might ask, Why now? Since the taxes for 2019-2020 is due in a month’s time? Well, if you have a new vehicle to report which is yet to be filed? And if you have plans to operate it over 5000 miles before 30th June 2019 now is the right time to do it. As per the IRS regulations it’s mandatory to file your vehicle for tax purposes, in failure to do so will attract penalty for late filing and payments of taxes.

So what does the IRS say?

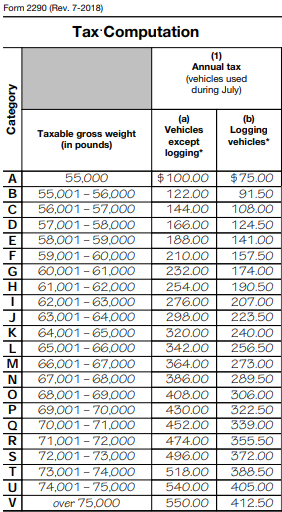

As per the Federal law it’s mandatory for all new vehicles to file the vehicle by the last day of the following month of its first use and the taxes are calculated based on the first month of use till June 30th, so the taxes will be calculated for the number of months used and miles to be driven (taxes are applicable for vehicles mileage over 5,000 or 7500 for agricultural vehicles)

Here at truckdues.com we avail multiple and secure modes of payment options, authorized by the federal govt. So why to worry? So, hurry up before it’s too late to file your tax returns and avoid any unnecessary penalties.

Truckdues.com has been rated to be one of the most cost effective websites amongst a major group of independent owner operators and trucking business for its much affordable price. E-File your pro-rated HVUT Form 2290 now and receive the IRS digital watermarked copy of schedule 1 back immediately in your registered e-mail address. Happy Trucking !!!