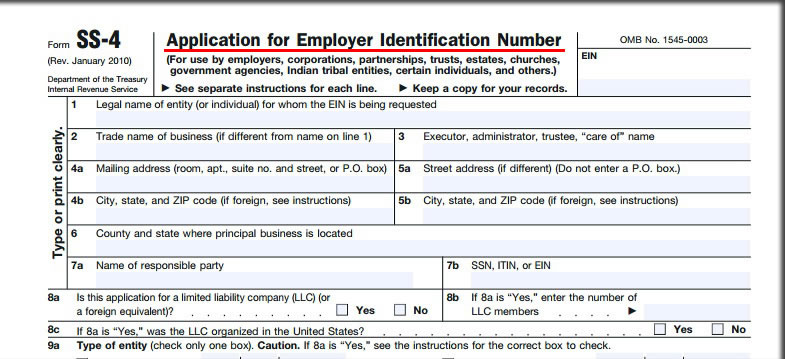

Truckers, now we approach you with this article to make you aware of the necessity of Employer Identification Number while filing your HVUT online. To be precise on this fact, many independent owner operators face rejections on their Form 2290 application when filed with their Social Security Number. Hence, we would like to give you an example of the scenarios of misconception that takes place during E-filing your HVUT. Continue reading

Greetings! You have landed at the right place in case you have been wondering why everyone’s talking laurels about e-filing over paper for long now. Obviously, you go green immediately, without wasting paper products of our beloved little left trees. The ability to file your tax returns round the clock throughout the week right at your desk at home makes life very comfortable and easy. The speed of the entire tax return process dramatically increases with e-filing over paper due to advanced INTERNET capabilities thus saving your hard earned money and energy worked out on postage/fax/courier/delivery charges, which of course can be used over a million other valuables.

Greetings! You have landed at the right place in case you have been wondering why everyone’s talking laurels about e-filing over paper for long now. Obviously, you go green immediately, without wasting paper products of our beloved little left trees. The ability to file your tax returns round the clock throughout the week right at your desk at home makes life very comfortable and easy. The speed of the entire tax return process dramatically increases with e-filing over paper due to advanced INTERNET capabilities thus saving your hard earned money and energy worked out on postage/fax/courier/delivery charges, which of course can be used over a million other valuables.  Are you still in the Stone Age by paper filing your Excise Tax returns? Guess what, more than 70 percent of the taxpayers file their taxes electronically. The IRS has processed over a billion HVUT returns safely and securely since the past decade, the Official beginning of E-filing ERA. Very few still stick with paper filing

Are you still in the Stone Age by paper filing your Excise Tax returns? Guess what, more than 70 percent of the taxpayers file their taxes electronically. The IRS has processed over a billion HVUT returns safely and securely since the past decade, the Official beginning of E-filing ERA. Very few still stick with paper filing  Hey there truckers, this article is to indicate that we got a near term tax deadline by Oct 31, only for the Heavy Vehicles which are operational on the road since Sep 2017. Despite that fact that how many days the truck was operational throughout the month, the HVUT would be due by the last day of the following month. Since, Form 2290 is due on any vehicle by the last day of the month following the month of its first use.

Hey there truckers, this article is to indicate that we got a near term tax deadline by Oct 31, only for the Heavy Vehicles which are operational on the road since Sep 2017. Despite that fact that how many days the truck was operational throughout the month, the HVUT would be due by the last day of the following month. Since, Form 2290 is due on any vehicle by the last day of the month following the month of its first use.  Hello Truckers, we’re back with yet another article to remind you about the near term HVUT deadline that waits by the end of this month Sep 30 for vehicles that are used on the road since Aug 2017. Form 2290 is generally due by June and its payable until the end of August. However, this law is only applicable for general annual renewals. Else, Form 2290 must be filed by the last day of the month following its month of its first use. On that basis Sep 30, would be the deadline to E-File Form 2290 for the vehicles which has been operated over public highway since Aug 2017.

Hello Truckers, we’re back with yet another article to remind you about the near term HVUT deadline that waits by the end of this month Sep 30 for vehicles that are used on the road since Aug 2017. Form 2290 is generally due by June and its payable until the end of August. However, this law is only applicable for general annual renewals. Else, Form 2290 must be filed by the last day of the month following its month of its first use. On that basis Sep 30, would be the deadline to E-File Form 2290 for the vehicles which has been operated over public highway since Aug 2017.

Though it’s not August now, it doesn’t mean that you can’t renew your Form 2290 for the Period beginning July 1, 2017 through June 30, 2018. You may E-file them now via

Though it’s not August now, it doesn’t mean that you can’t renew your Form 2290 for the Period beginning July 1, 2017 through June 30, 2018. You may E-file them now via  If this rings a bell in your mind, probably you missed your HVUT Form Renewal. The Deadline to E-Renew Form 2290 for the period beginning July 1, 2017 through June 2018 was Aug 31, 2017. However, we realize that everyone can’t really afford time to spare towards E-filing Form 2290 during this time due to their busy work schedule. Hence, it doesn’t mean that it’s the end of the road. You may still renew your Form 2290’s now for the Period beginning July 2017 through June 2018 right now to stay away from incurring more penalties towards late filing and late payment of HVUT taxes.

If this rings a bell in your mind, probably you missed your HVUT Form Renewal. The Deadline to E-Renew Form 2290 for the period beginning July 1, 2017 through June 2018 was Aug 31, 2017. However, we realize that everyone can’t really afford time to spare towards E-filing Form 2290 during this time due to their busy work schedule. Hence, it doesn’t mean that it’s the end of the road. You may still renew your Form 2290’s now for the Period beginning July 2017 through June 2018 right now to stay away from incurring more penalties towards late filing and late payment of HVUT taxes.  Truckers, we are now just at a couple of days away from the HVUT tax deadline. Just 48 hours left until renewing your Form 2290 for the period beginning July 1, 2017 through June 30, 2018. All the last moment filers are online now to E-renew them Form 2290’s. In case you haven’t e-filed your Form 2290 yet, Log on to www.truckdues.com and e-file your Form 2290’s ASAP and receive the IRS watermarked copy of schedule 1 in your e-mail instantly.

Truckers, we are now just at a couple of days away from the HVUT tax deadline. Just 48 hours left until renewing your Form 2290 for the period beginning July 1, 2017 through June 30, 2018. All the last moment filers are online now to E-renew them Form 2290’s. In case you haven’t e-filed your Form 2290 yet, Log on to www.truckdues.com and e-file your Form 2290’s ASAP and receive the IRS watermarked copy of schedule 1 in your e-mail instantly.