Hello there dear Truckers, as you know the HVUT Form 2290 is an annual tax paid to the Internal Revenue Service every year on a vehicle which comprises a minimum gross weight of 55000 lbs or more and if the same truck is been used over the public highways for commercial, agricultural & logging purposes. In recent times we see a lot of our customers come up with questions relating to Form 2290 claims and who are eligible for it. We hope this blog covers those questions.

Now there are few claims that are supported in accordance with the Form 2290.

- Taxes Overpaid Credits.

- Suspended Vehicle Exceeds Mileage.

- Low Mileage Vehicle Credits.

Claims against Tax overpayment: When the taxes are paid for a respective vehicle more than once within the same tax year, then the excess paid amount can be claimed as a refund by filing the Claim Form 8849 Schedule 6, as a result, you will receive a refund check back from the IRS in 21 business days in your mailing address.

When the vehicle is Sold/Destroyed/Stolen: When the taxes are paid full in advance on a respective vehicle and if the subjected vehicle is Sold/Destroyed/Stolen a partial refund can be claimed via the Form 8849 Schedule 6.

Low Mileage vehicle credit: When the taxes are paid full in advance on a vehicle assuming it would go over 5000 miles or 7500 miles but if the truck remains under the mileage limit for exemption during the year, the IRS lets you claim a full refund by the following tax year.

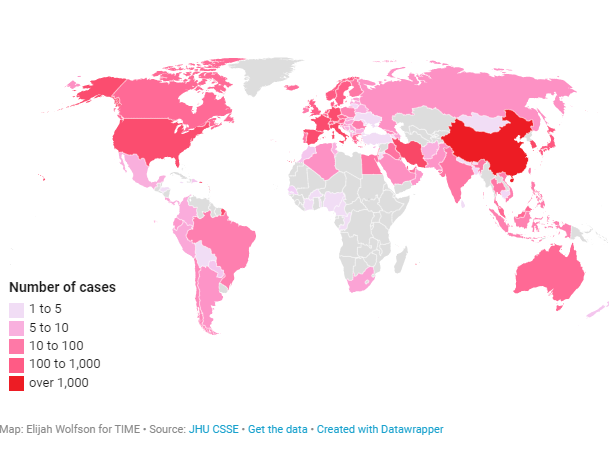

It’s a pandemic out there and the nation needs more truckers as you’re the bloodlines that connect every nook and corner of our country. We see a lot of our customers trading in trucks and looking to transfer the credits. Now you know what to do and if further assistance is needed, please feel free to contact us at 347-515-2290 or just drop an email to support@truckdues.com. Drive safe