Hello there Truckers, Today is the last day to E-File your Pro-rated HVUT Form 2290 (For the Period beginning Dec 2018 through June 2019) to the IRS. This deadline is only applicable for vehicles which are purchased/re-purchased and been used on the road since Dec 2018.

Basically the HVUT Form 2290 is due by the month of June and its payable until the end of August. However, if any vehicles are purchased at the middle of a respective tax period the said vehicle is liable to be reported on the Form 2290 on a Pro-rated basis before the last day of the month following the month of its first use.

On this basis, the Pro-rated Form 2290 would be due by January 31st, 2019 for vehicles which are into service from December 2018. However, before filing your pro-rated HVUT you must be able to guess the number of miles the truck would travel during the respective tax period it’s reported for.

The Internal Revenue Service sets the desired mileage of exemption to be 5000 miles (For commercial & logging vehicles) and 7500 miles (For Agricultural Vehicles). Now if the subjected vehicles seems not to exceed this mileage limit based on its nature of purpose it remains exempt from paying taxes to the IRS however the tax return needs to be filed to report an exemption.

On the other hand if the vehicles does seem to exceed the mileage of exemption for the period its intended to be reported, you’ve got to make the tax payment full in advance to the Internal revenue service. Soon as you e-file your tax return, you will receive the IRS digital watermarked copy of schedule 1 in your registered e-mail address.

Feel free to reach us back for any further assistance over the following mediums:

Phone: (347) 515-2290 [Monday through Friday, 9 A.M to 5 P.M, Central Standard Time]

E-mail: support@truckdues.com

Live chat with our tax representatives.

Have a Good One! See you over the next article.

Though it’s not August now, it doesn’t mean that you can’t renew your Form 2290 for the Period beginning July 1, 2017 through June 30, 2018. You may E-file them now via

Though it’s not August now, it doesn’t mean that you can’t renew your Form 2290 for the Period beginning July 1, 2017 through June 30, 2018. You may E-file them now via  If this rings a bell in your mind, probably you missed your HVUT Form Renewal. The Deadline to E-Renew Form 2290 for the period beginning July 1, 2017 through June 2018 was Aug 31, 2017. However, we realize that everyone can’t really afford time to spare towards E-filing Form 2290 during this time due to their busy work schedule. Hence, it doesn’t mean that it’s the end of the road. You may still renew your Form 2290’s now for the Period beginning July 2017 through June 2018 right now to stay away from incurring more penalties towards late filing and late payment of HVUT taxes.

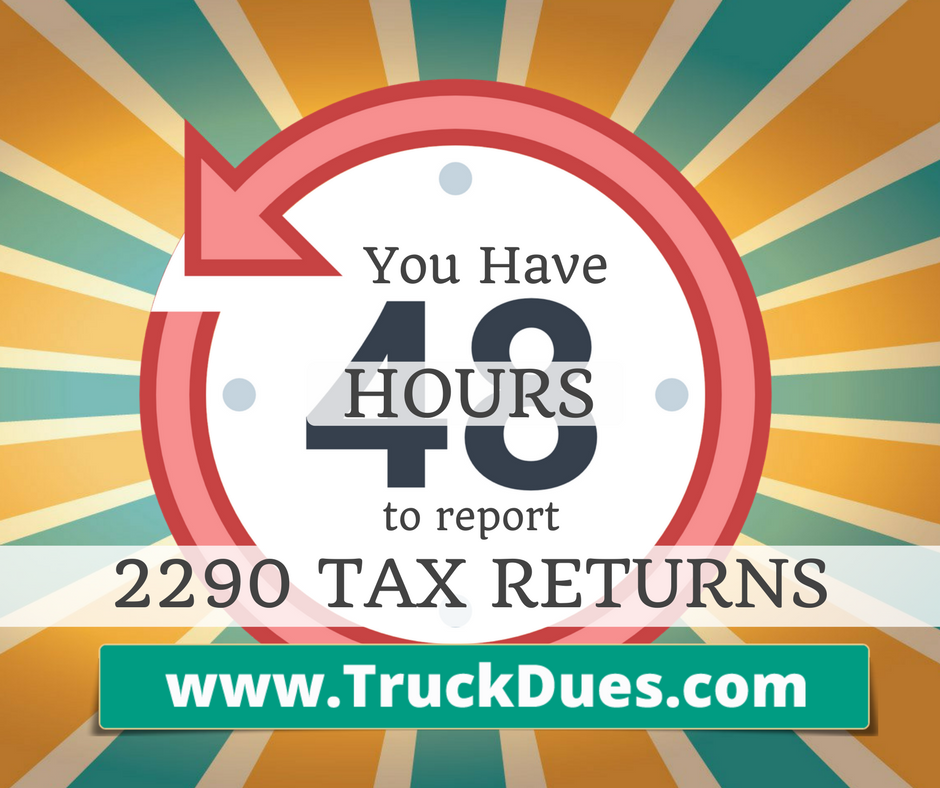

If this rings a bell in your mind, probably you missed your HVUT Form Renewal. The Deadline to E-Renew Form 2290 for the period beginning July 1, 2017 through June 2018 was Aug 31, 2017. However, we realize that everyone can’t really afford time to spare towards E-filing Form 2290 during this time due to their busy work schedule. Hence, it doesn’t mean that it’s the end of the road. You may still renew your Form 2290’s now for the Period beginning July 2017 through June 2018 right now to stay away from incurring more penalties towards late filing and late payment of HVUT taxes.  Truckers, we are now just at a couple of days away from the HVUT tax deadline. Just 48 hours left until renewing your Form 2290 for the period beginning July 1, 2017 through June 30, 2018. All the last moment filers are online now to E-renew them Form 2290’s. In case you haven’t e-filed your Form 2290 yet, Log on to www.truckdues.com and e-file your Form 2290’s ASAP and receive the IRS watermarked copy of schedule 1 in your e-mail instantly.

Truckers, we are now just at a couple of days away from the HVUT tax deadline. Just 48 hours left until renewing your Form 2290 for the period beginning July 1, 2017 through June 30, 2018. All the last moment filers are online now to E-renew them Form 2290’s. In case you haven’t e-filed your Form 2290 yet, Log on to www.truckdues.com and e-file your Form 2290’s ASAP and receive the IRS watermarked copy of schedule 1 in your e-mail instantly.  Truckers, it’s now high time to E-file your Form 2290 for the period beginning July 1, 2017 through June 30, 2018. Several thousands of tax payers, who procrastinated on their HVUT deadline, would be braced now to E-file their Form 2290 at the very last moment. Things done at the last moment creates space for human errors. So, after you read this article you must be aware that you’re almost near the deadline as its due in just 4 days and we don’t want you to prolong it anymore.

Truckers, it’s now high time to E-file your Form 2290 for the period beginning July 1, 2017 through June 30, 2018. Several thousands of tax payers, who procrastinated on their HVUT deadline, would be braced now to E-file their Form 2290 at the very last moment. Things done at the last moment creates space for human errors. So, after you read this article you must be aware that you’re almost near the deadline as its due in just 4 days and we don’t want you to prolong it anymore.  Time waits for none, it really matters how we efficiently utilize the time in getting our works done. The same saying applies when it comes to your HVUT Form 2290 deadline, The IRS let you e-filing your Form 2290 for the period beginning July 1, 2017 through June 30, 2018 since the beginning of July 2017. They gave you 90 days before you can e-renew your Form 2290, by far 55 days has passed by, hence we got very less time left behind to meet the deadline.

Time waits for none, it really matters how we efficiently utilize the time in getting our works done. The same saying applies when it comes to your HVUT Form 2290 deadline, The IRS let you e-filing your Form 2290 for the period beginning July 1, 2017 through June 30, 2018 since the beginning of July 2017. They gave you 90 days before you can e-renew your Form 2290, by far 55 days has passed by, hence we got very less time left behind to meet the deadline.  So, how was your experience witnessing the all American total eclipse yesterday? It would sure have been a joyous moment for many across the nation to witness the once in Life time path of Totality. However, now the eclipse is over so does yesterday.

So, how was your experience witnessing the all American total eclipse yesterday? It would sure have been a joyous moment for many across the nation to witness the once in Life time path of Totality. However, now the eclipse is over so does yesterday.