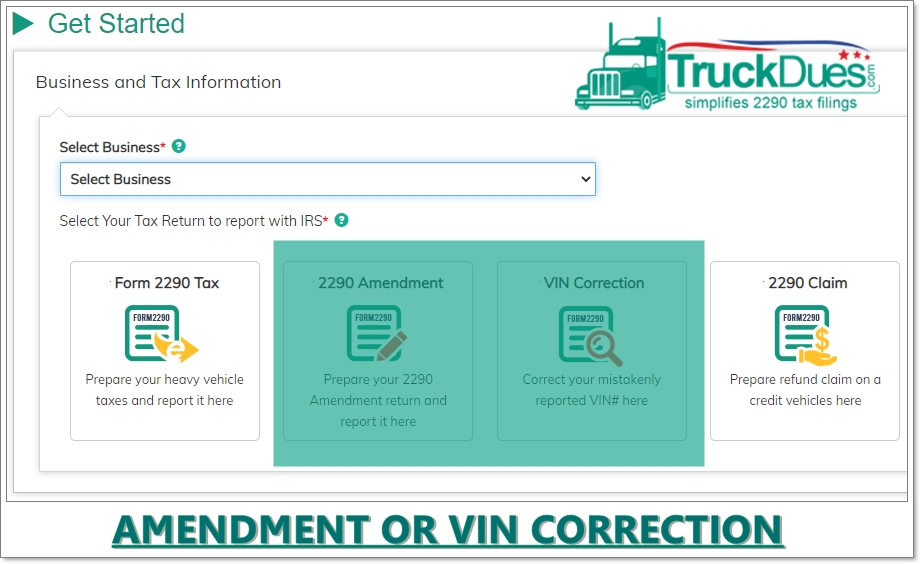

Hello there truckers, over this article we are going to discuss on how to go about reporting an increase in the Gross weight of your truck. We on daily basis receive calls from our clients required to file an amended 2290. Often customers confuse between VIN correction and amendments. If you have done a mistake on the VIN numbers you have to do a VIN correction, If you have to correct the mistake occurred on their taxable gross weight of the vehicle that’s when you do an amendment. Now refers to this article to get a clear picture on this scenario.

Basically the Form 2290 is known to be the Heavy Highway vehicle used tax return which is filed on vehicles which possess a minimum gross weight of 55000 lbs or more and if the same truck is been used over the public highway for commercial purposes.

Continue reading